2020 Macroeconomic Overview & Financial markets (Fundación Mapfre's viewpoint)

- CATRisk Consultants

- 19 jul 2020

- 2 Min. de lectura

Actualizado: 21 oct 2020

General Overview

The third quarter of the year was marked by three relevant factors:

(i) the deepening slow down of global activity, with the Eurozone, and Germany , being especially key;

(ii) the shift of the global monetary policy toward change in base rates

(iii) the dynamics of international and domestic policies with clear effects on stability, growth and the confidence of economic agents.

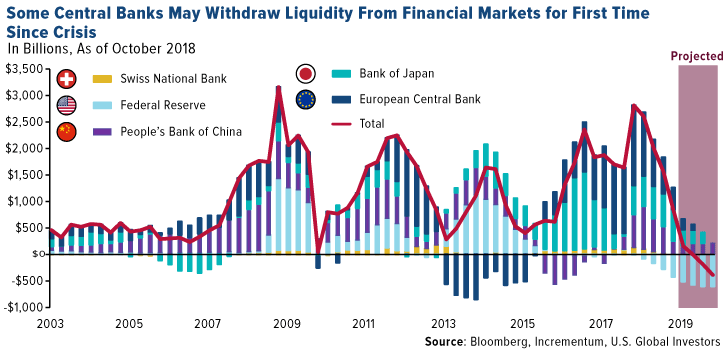

Germany might have entered recession in the third quarter of the year, since the information they are releasing continues to confirm a clear deceleration of activity: industrial production, factory orders, export orders and automobile sales. Italy is at a standstill, and activity indicators are negative as well. This will all unavoidably weight on Eurozone outlooks and on the economic performance of its members, with specific relevance for Spain, given its close commercial ties. With no inflationary pressure, and with clear signs of global deceleration, the majority of the world’s central banks are in the midst of a monetary relaxation phase, be it with visible reductions of the reference rate, or with balance sheet increases or more exotic measures like reducing the reserve ratio (in emerging countries) or increasing negative deposit rates (Economic and Monetary Union of the EU).

In the United States, at its meeting in September, the Federal Reserve lowered interest rates 25 basis points (bps), and another cut is expected before the end of the year, with the justification that the global deceleration and trade tensions are having an impact on activity and employment.

The European Central Bank (ECB) also took action at its meeting in September, lowering deposit facility rates 10 bps and restarting the asset purchase program as of November 1st, without indicating an end date. Regarding the risk balance sheet, with an ever greater proportion of bonds with negative yields globally, the markets are nervous, and interest rate curves suggest that the probabilities of recession

are growing.

The question on investors’ minds now is focused on whether or not the central banks and governments will be able to mitigate the deceleration and avoid a recession with their policies, and if these measures will be enough to avoid adverse scenarios.

The general feeling is that assets (bonds, stocks, real estate) are over-valued after a decade of strong monetary stimuli. In this context, in September, in addition to the Federal Reserve and the ECB, interest rates went down in Brazil (-50 bps, to 5.50 percent), Mexico (- 25 bps to 7.75%), Turkey (-325 bps, to 16.50 percent), Indonesia (-25 bps, to 5.25 percent) and Philippines (-25 bps, to 4.0 percent). China is also applying stimulus measures, lowering the required reserves for banks (-50 bps, to 13.0 percent).

Fuente: Fundación Mapfre 2019 Financial Report January - September

United States

The US economy grew 2.0 percent in the second quarter of the year (2.3 percent year on year), with private consumption picking up (4.7 percent), but investment falling -6.1 percent. Exports have been falling for four straight quarters (-0.6 percent in the second quarter) due to trade tensions, though to a lesser extent. It is worth highlighting that on October 15th, tariffs applicable to 228 billion USD worth of products increased from 25 to 30 percent, and on December 15th a new 15 percent tariff applicable to another 156 billion USD of products will go into effect, the latter including cell phones and laptops. Economic indicators, including the Purchasing Managers’ Indexes (PMIs), show that the US economy is…

Spain

Spain grew 0.4 percent in the second quarter, with year on year standing at 2.0 percent. In the quarter, consumption has not grown, exports have picked up 1.7 percent, and imports have also picked up (+0.9 percent). Private consumption, which is supported by earnings from employment, is also losing its momentum. Unemployment stood at 13.8 percent in August (adjusted for seasonality) and a certain exhaustion in job creation is beginning to be noticeable. In the latest PMI advances, the composite and the service PMIs show that there is still growth momentum, while the industrial sector is in contraction (47.7). The Spanish economy is not immune to the deceleration happening abroad, but the favourable financing conditions and its distinct cyclical…

Eurozone: inflation has been falling for a year and moving away from the 2 percent objective, standing at 0.9 percent in September (advance data), with underlying at 1.0 percent, primarily due to energy prices.

Eurozone

The Eurozone is slowing down over the course of 2019. The GDP grew only 0.2 percent in the second quarter, placing the annual rate at 1.2 percent. Industrial production is in recession (-2.0 percent) and on a downward trend. The final manufacturing PMIs were revised slightly up in September to 45.7 points, but show the eighth consecutive month of a decline in activity

PANORAMA ECONÓMICO Y SECTORIAL 2020

Se presenta el panorama económico global y se ofrece una perspectiva y balance de riesgos para un grupo de economías seleccionadas, en tanto que en el segundo se hace un análisis de la forma en que el entorno económico podrá afectar el comportamiento de la demanda aseguradora. Este análisis se complementa con previsiones para el período 2020-2021, tanto de las principales variables macroeconómicas como de la demanda aseguradora No Vida, el segmento mayormente afectado por el comportamiento del ciclo económico general.

En lo que se refiere al sector asegurador, la dinámica de la economía global sigue afectando su desarrollo y, en particular, el de los segmentos de No Vida y Vida riesgo. Por una parte,…