International banking supervision: exposure management

- CATRisk Consultants

- 12 feb 2021

- 10 Min. de lectura

Quantitative impact study results

Basel committee on banking supervision 2006 QIS5 results

Most used Banking solvency measures are CET1 ratio and LR leverage ratio.

To evaluate the effects of the Basel II Framework on capital levels, the Basel Committee undertook a global fifth Quantitative Impact Study (QIS 5) in 31 countries. All G10 countries (except the US) and 19 non-G10 countries participated in the exercise. This report summarises the results of QIS 5. The Secretariat of the Basel Committee received data from 56 Group 1 banks located in the G10 countries, 146 G10 Group 2 banks (including some German banks on the basis of QIS 4 returns), and 155 banks from other countries. Limited data from the US QIS 4 exercise – an additional 26 institutions – were also included where possible. The Committee appreciated the substantial efforts banks and national supervisors put into this data collection exercise.

The primary objective of the study was to allow the Committee to evaluate the potential changes in minimum required capital levels under the Basel II Framework as the industry progresses toward implementation.

The QIS results for the G10 countries show that minimum required capital under Basel II (including the 1.06 scaling factor to credit risk-weighted assets) would decrease relative to the current Accord. For Group 1 banks, minimum required capital under the most likely approaches to credit and operational risk would on average decrease by 6.8%. Among the two IRB approaches, the advanced approach shows more reduction in minimum required capital (-7.1%) than the foundation approach (-1.3%). Minimum required capital under the standardised approach would increase by 1.7% for Group 1 banks. However, only few G10 Group 1 banks are expected to adopt this approach. Group 2 banks show a larger reduction in minimum required capital under the internal ratings-based approaches, and minimum required capital would decrease by 1.3% under the standardised approach, in particular due to the higher proportion of retail exposures for those banks.

The retail mortgage portfolio contributes the most to the reduction in minimum required capital under the standardised and the IRB approaches (-6.3% to -7.6% for G10 Group 1 banks). Since there was no explicit capital charge for operational risk under Basel I, the highest increase is due to the new capital requirements for operational risk (5.6% to 6.1% for G10 Group 1 banks). For Group 1 banks under the IRB approaches, the other main contributing portfolios are corporate and SME retail (decreases) as well as equity (increase). Although dispersion of the results has decreased for some portfolios compared to QIS 3, it is still fairly large.

It is important to note that macroeconomic conditions in most countries at the time of QIS 4 and 5 were more benign than during QIS 3. The Committee concluded in May 2006 that this influenced the results, but currently available information does not allow the impact to be quantified any more accurately. Also taking into account the remaining uncertainties in the data, the Committee agreed that no adjustment of the scaling factor of 1.06 to credit riskweighted assets under the internal ratings-based approaches would be warranted at this stage. The Committee expects that in the course of implementing the Basel II Framework, supervisors will ensure that banks will maintain a solid capital base throughout the economic cycle. The Committee believes that mechanisms are in place to achieve this goal. National authorities will continue to monitor capital requirements during the implementation period of the Basel II Framework. Moreover, the Committee will monitor national experiences with the Basel II Framework.

Methodology

In order to ensure comparability across approaches, the impact of the Basel II Framework is measured in terms of percentage changes in minimum required capital (MRC). In practice, minimum required capital measures the capital required to cover (i) 8% times risk-weighted assets; (ii) a potential difference between the total expected loss amount and total eligible provisions (i.e. the regulatory calculation difference – RCD) under the IRB approaches; and (iii) deductions other than the regulatory calculation difference. Under the IRB approaches, risk-weighted assets are calculated on a EL-only basis and include the 1.06 scaling factor to IRB credit risk-weighted assets. Market risk-weighted assets were computed – in a few cases using the new trading book rules – and operational risk-weighted assets were derived to complete the risk-weighted asset figure. In addition, this regulatory calculation difference was allocated to the portfolios on an expected loss (EL) basis in order to compare changes in minimum required capital by portfolio. The percentage change in minimum required capital is decomposed, isolating the contribution of the regulatory calculation difference from the impact of the other components.

Similarly, the impact of Basel II on minimum required Tier 1 capital has been calculated, taking into account changes to the capital only to the extent they have an impact on Tier 1 capital. However, unless stated otherwise, the term minimum required capital always refers to total minimum required capital.

To analyse the impact of the Basel II Framework at the portfolio level, the so-called contribution to the portfolio is used. The contribution can in general be calculated by multiplying the portfolio size by the change in minimum required capital under Basel II relative to minimum required capital under the current Accord at the portfolio level.

As bank weights for aggregation within a country, the share of a Group 1 bank, to the total minimum required capital under the current Accord, relative to Group 1 banks participating in QIS 5, in a certain country was used. In addition, the portfolio size is taken into account, in the aggregation of portfolio-level minimum required capital. For Group 2 banks, simple averages are used.

In order to aggregate results of the various countries in the sample and to determine the overall change of capital in the global banking system, country weights are assigned to each country’s total change in minimum required capital. Results of Group 1 banks are weighted by the proportion of Tier 1 plus Tier 2 capital, less deductions, of all Group 1 banks in the banking system of each country, irrespective of whether or not they participated in the data collection exercise. For Group 2 banks, results are weighted based on the capital of Group 2 banks in each country.

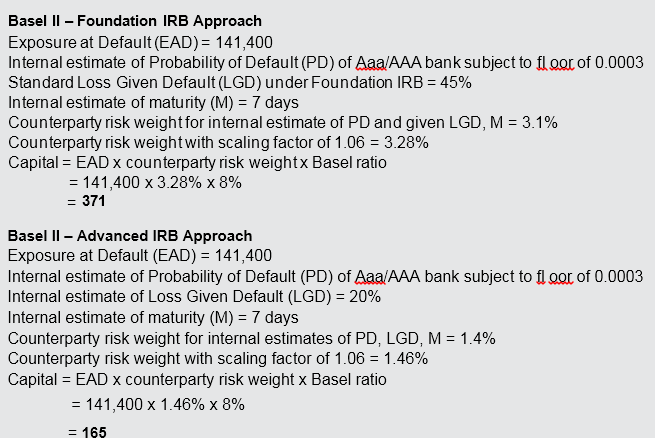

FIRB foundation internal rating ~internal model approach. AIRB Advanced internal rating ~ internal model approach

For Group 1 banks in G10 countries, minimum required capital under the most likely approach would decrease by 6.8%. Among the two IRB approaches, the advanced approach shows more reduction in minimum required capital (-7.1%) than the foundation approach (-1.3%). Minimum required capital under the standardised approach would increase by 1.7%, however, very few G10 Group 1 banks are expected to adopt this approach. For G10 Group 2 banks, the reduction in minimum required capital is bigger. Minimum required capital under the most likely approach would decrease by 11.3%, while reductions under the standardised, the foundation IRB and the advanced IRB approaches are 1.3%, 12.3% and 26.7% respectively. Some of the main factors which were pointed out by G10 countries as reasons for the reduction in minimum required capital are a favourable macroeconomic environment in which banks operate and the contribution of the mortgage portfolio (G10 Group 1 - 26.5% retail of which 22.3% is mortgage, G10 group 2 - 36% retail of which 22.1% mortgage portfolio)

IRB approaches

Overview of portfolio results

Table above presents the contribution of portfolios to the changes in minimum required capital for banks in G10 countries under the most likely IRB approach. Minimum required capital for G10 Group 1 banks declined by 4.5%, while G10 Group 2 banks show a decline in minimum required capital of 14.1%. Group 1 banks in the G10 countries are by definition diversified and internationally active banks and therefore involved in wholesale activities, while the Group 2 banks are typically more focused on retail business, which explains the larger decline in minimum required capital for the Group 2 banks.

As noted in the standardised section, the largest capital driver for both groups is residential mortgages (7.6% decrease for Group 1 banks). For G10 Group 1 banks, the other main drivers are corporate portfolios (5.0% decrease) and operational risk (6.1% increase). G10 Group 2 banks have larger shares of mortgage lending, thus their contribution of residential mortgages to the overall change is larger at -12.6%. Other contributing factors for G10 Group 2 banks include operational risk (7.5% increase), other retail (4.5% decrease), and SME retail (3.3% decrease). Both the corporate and SME corporate portfolios show decreases in minimum required capital.

[1] These figures differ from the results presented previously since the Group 1 figures exclude the US data, and Group 2 results exclude those banks for which the standardised approach is the most likely approach.

Retail residential mortgage (RM)

For G10 Group 1 banks, the weighted average of the retail residential mortgage portfolio LGD across the whole sample is equal to 20.3%, with individual banks’ LGDs ranging between 10.0% and 54.6%. For G10 Group 2 banks, both the weighted average LGD and the dispersion across countries are slightly higher (26.2% on average with values ranging between 10.0% and 68.2%). Whilst, some of this dispersion does actually reflect differences in individual firms’ risk profile and workout practices (including differences in banks’ average loan-to-value ratios), differences in assumptions made when estimating these factors, methodologies and system limitations have still played an important role. Furthermore, particularities of the different markets have also contributed to the differences to some extent; for example, residential mortgages are government-insured in some countries, resulting in particularly low LGDs.

Wholesale exposure (LGD Loss Given Default ~ Probabilidad de incumplimiento)

The dispersion of LGDs for the wholesale portfolios for G10 Group 1 banks targeting the advanced IRB approach is on average slightly lower than that emerging from the analysis of retail portfolios. The highest dispersion across portfolios is shown by the sovereign portfolio with individual firms’ values ranging from 1.9% to 65.6% with an average of 33.3%. The dispersion is partly attributable to characteristics of the underlying investments ranging from US government bills and bonds to emerging countries debt.

The bank portfolio presents the second highest dispersion across the wholesale portfolios with LGDs ranging from 10.8% to 67.6% (the average for G10 Group 1 is equal to 40.9%). Some dispersion is also displayed by the SME corporate portfolio where the average LGD for G10 Group 1 is equal to 35.0%, but values range from 16.3% to 54.5%. Finally, a lower level of dispersion is shown by the corporate portfolio: LGDs range between 29.1% and 56.3% (the average LGD is equal to 39.8%).

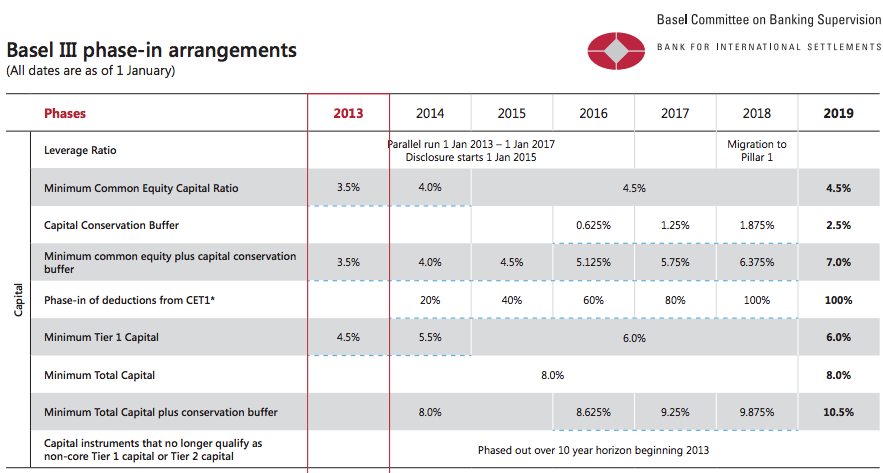

Strengthening the global capital framework

The Basel Committee is raising the resilience of the banking sector by strengthening the regulatory capital framework, building on the three pillars of the Basel II framework. The reforms raise both the quality and quantity of the regulatory capital base and enhance the risk coverage of the capital framework. They are underpinned by a leverage ratio that serves as a backstop to the risk-based capital measures, is intended to constrain excess leverage in the banking system and provide an extra layer of protection against model risk and measurement error. Finally, the Committee is introducing a number of macroprudential elements into the capital framework to help contain systemic risks arising from procyclicality and from the interconnectedness of financial institutions.

It is critical that banks’ risk exposures are backed by a high-quality capital base. The crisis demonstrated that credit losses and write-downs come out of retained earnings, which is part of banks’ tangible common equity base. It also revealed the inconsistency in the definition of capital across jurisdictions and the lack of disclosure that would have enabled the market to fully assess and compare the quality of capital between institutions.

Cyclicality of the minimum requirement

The Basel II framework increased the risk sensitivity and coverage of the regulatory capital requirement. Indeed, one of the most procyclical dynamics has been the failure of risk management and capital frameworks to capture key exposures – such as complex trading activities, securitisations and exposures to off-balance sheet vehicles – in advance of the crisis. However, it is not possible to achieve greater risk sensitivity across institutions at a given point in time without introducing a certain degree of cyclicality in minimum capital requirements over time. The Committee was aware of this trade-off during the design of the Basel II framework and introduced several safeguards to address excess cyclicality of the minimum requirement. They include the requirement to use long term data horizons to estimate probabilities of default, the introduction of so-called downturn loss-given-default (LGD) estimates and the appropriate calibration of the risk functions, which convert loss estimates into regulatory capital requirements. The Committee also required that banks conduct stress tests that consider the downward migration of their credit portfolios in a recession.

The Committee has reviewed a number of additional measures that supervisors could take to achieve a better balance between risk sensitivity and the stability of capital requirements, should this be viewed as necessary. In particular, the range of possible measures includes an approach by the Committee of European Banking Supervisors (CEBS) to use the Pillar 2 process to adjust for the compression of probability of default (PD) Basel III: A global regulatory framework for more resilient banks and banking systems estimates in internal ratings-based (IRB) capital requirements during benign credit conditions by using the PD estimates for a bank’s portfolios in downturn conditions. Addressing the same issue, the UK Financial Services Authority (FSA/Bank of England PRA) has proposed an approach aimed at providing non-cyclical PDs in IRB requirements through the application of a scalar that converts the outputs of a bank’s underlying PD models into through-the-cycle estimates.

Forward looking provisioning

The Committee is promoting stronger provisioning practices through three related initiatives. First, it is advocating a change in the accounting standards towards an expected loss (EL) approach. The Committee strongly supports the initiative of the IASB to move to an EL approach. The goal is to improve the usefulness and relevance of financial reporting for stakeholders, including prudential regulators. It has issued publicly and made available to the IASB a set of high-level guiding principles that should govern the reforms to the replacement of IAS 39.6 The Committee supports an EL approach that captures actual losses more transparently and is also less procyclical than the current “incurred loss” approach. Second, it is updating its supervisory guidance to be consistent with the move to such an EL approach. Such guidance will assist supervisors in promoting strong provisioning practices under the desired EL approach Third, it is addressing incentives to stronger provisioning in the regulatory capital framework.

Capital conservation

The Committee is introducing a framework to promote the conservation of capital and the build-up of adequate buffers above the minimum that can be drawn down in periods of stress.

Addressing systemic risk and interconnectedness

Several of the capital requirements introduced by the Committee to mitigate the risks arising from firm-level exposures among global financial institutions will also help to address systemic risk and interconnectedness. These include: Basel III: A global regulatory framework for more resilient banks and banking systems · capital incentives for banks to use central counterparties for over-the-counter derivatives; · higher capital requirements for trading and derivative activities, as well as complex securitisations and off-balance sheet exposures (eg structured investment vehicles); · higher capital requirements for inter-financial sector exposures; and · the introduction of liquidity requirements that penalise excessive reliance on short term, interbank funding to support longer dated assets.

Source: Basel committee on banking supervision 2010

Basel committee on banking supervision 2006 QIS5 Results

Bank for International Settlements

Basel III: a global regulatory framework for more resilient banks and banking systems.

Banks must ensure that their countercyclical buffer requirements are calculated and publically disclosed with at least the same frequency as their minimum capital requirements. In addition, when disclosing their buffer requirement, banks must also disclose the geographic breakdown of their private sector credit exposures used in the calculation of the buffer requirement.

The countercyclical capital buffer aims to ensure that banking sector capital requirements take account of the macro-financial environment in which banks operate. Its primary objective is to use a buffer of capital to achieve the broader macroprudential goal of protecting the banking sector from periods of excess aggregate credit growth that have often been associated with the build-up of system-wide risk.

Countercyclical capital buffer (CCyB) (bis.org)

El Comité de Supervisión Bancaria de Basilea (BCBS por sus siglas en inglés) anunció el pasado mes de diciembre la finalización de la revisión del marco de Basilea III que permitirá afrontar mejor las crisis financieras. Los nuevos estándares, que entrarán en vigor en enero de 2022, deberían ayudar a clarificar y traer mayor estabilidad al marco regulatorio global.

es previsible la publicación del primer borrador europeo que transponga los últimos estándares de Basilea III, después del retraso experimentado por la pandemia. Este paquete regulatorio será muy relevante, ya que incluirá cambios muy significativos en el cálculo de requerimientos de capital para todos los riesgos, especialmente los de crédito, mercado y operacional. Y además incluye una nueva medida que limita la ventaja de usar modelos internos, el suelo de capital, que apunta a ser uno de los elementos principales de la negociación. Esperamos que la Comisión Europea publique su informe después del verano, dando así inicio a un proceso legislativo que podría extenderse entre 2 y 3 años.

Por último, Europa seguirá impulsando las iniciativas de integración económica, centradas…